Does Insurance Cover Broken Car Windows? A Complete Guide

Does insurance cover broken car windows? Yes, but it depends. Find out which policy you need, how deductibles work, and when to file a claim for auto glass.

Jan 11, 2026

generated

does insurance cover broken car windows, auto glass insurance, comprehensive coverage, car window claim, glass deductible

So, you’ve got a broken car window. The big question is, will your insurance cover it? The short answer is yes, but it all comes down to which coverage you have. If you only carry a basic liability policy, you're likely out of luck. For this kind of damage, comprehensive coverage is what you need.

What Your Car Insurance Actually Covers for a Broken Window

Finding your car with a shattered window is one of those gut-sinking moments that immediately makes you think about the cost. The good news is, your auto insurance policy is built for this—as long as you have the right pieces in place. Think of it like a toolkit. You need the right tool for the job.

The most basic tool in that kit is liability coverage, which is required in almost every state. Its sole purpose is to pay for damage you cause to other people or their property in an accident. It does absolutely nothing for your own vehicle, including its windows. This is a huge point of confusion for a lot of drivers and can lead to a surprise bill.

Why Comprehensive Coverage Is Your Best Friend Here

When it comes to your own car’s glass, comprehensive coverage is the hero of the story. This is an optional add-on that protects your car from damage that isn't related to a collision. It’s designed for all the random, unpredictable things life throws at your vehicle.

So, when does comprehensive kick in? Here are a few classic examples:

Theft or Vandalism: Someone smashes your window to break in.

Road Debris: A truck kicks up a rock on the highway, and it cracks your windshield.

Falling Objects: A heavy tree branch lands on your car during a storm.

Weather Damage: A hailstorm leaves your windows pockmarked or shattered.

Bottom line: If your window breaks and it wasn't part of a car accident, your comprehensive policy is what you'll turn to.

Let's break down the difference in a simple way.

Coverage At A Glance: Liability Vs. Comprehensive

Scenario | Liability-Only Coverage | Comprehensive Coverage |

|---|---|---|

A rock cracks your windshield on the highway | Not Covered. This is damage to your own car. | Covered. This is a classic road debris incident. |

Someone breaks your side window to steal a bag | Not Covered. Liability doesn't cover theft. | Covered. This falls under vandalism and theft. |

A tree limb falls on your car during a storm | Not Covered. This is an act of nature. | Covered. This is considered non-collision damage. |

You back into a pole, and the rear window shatters | Not Covered. Your own fault, your own damage. | Not Covered. This is a collision, which falls under a separate collision policy. |

This distinction is key no matter where you are, from the U.S. to the UK and beyond. Realizing its importance, about 80–85% of insured drivers in the U.S. choose to add comprehensive coverage to their policies. They see it as a smart way to protect their investment from everyday risks. You can get more insights into the car insurance market and its trends to see why it's so popular.

Understanding the difference between these coverages is the first step. For most drivers, having comprehensive turns a broken window from a major financial headache into a manageable inconvenience.

Getting to Know Your Auto Insurance Policy

So, does your insurance actually cover a broken car window? To get a real answer, you have to look past the general question and dig into the specifics of your policy. Think of your insurance not as one single thing, but as a toolkit. Each tool, or coverage type, is designed for a very specific job. Just having "insurance" isn't the whole story; you need the right tool for the job to handle glass damage.

Let's break down the three main players you'll find in most auto policies: Liability, Collision, and Comprehensive. They can seem confusing, but each one has a distinct role.

Comprehensive Coverage: The Hero for Glass Damage

For almost any window damage that doesn't happen in a car crash, Comprehensive Coverage is what you'll need. It's often called "other than collision" coverage, and that's a perfect description. It protects your car from all sorts of unfortunate events that aren't your fault.

Here are a few real-world situations where comprehensive coverage becomes your financial safety net:

Vandalism or Theft: A thief smashes your side window to grab a bag off the seat.

Acts of Nature: A nasty hailstorm cracks your windshield and shatters the back glass.

Falling Objects: During a windstorm, a heavy branch snaps and lands on your car, cracking the sunroof.

Road Debris: A truck ahead of you on the highway kicks up a rock, leaving a chip or crack in your windshield.

In every one of these cases, the damage wasn't caused by a collision, so your comprehensive policy is designed to step in and pay for the repair or replacement, minus your deductible. This is the single most important coverage when you're asking, "does insurance cover a broken car window?" For a closer look at how this works for windshields specifically, check out our guide on how insurance covers windshield replacement.

When Collision Coverage Comes Into Play

While comprehensive is the go-to for most glass issues, Collision Coverage has a very specific job. This policy is there to fix your own car after an accident you're at fault for, like hitting another vehicle or backing into a pole.

If your window breaks as a direct result of that kind of accident—say, a fender bender where the impact shatters your passenger-side glass—then your collision policy would cover it. It just gets bundled into the overall repair claim for your vehicle. The downside? You'll have to pay your collision deductible, which is usually a lot higher than your comprehensive one.

The Special Case: Full Glass Coverage

In some states, insurers offer a special add-on that's like a VIP pass for your car's glass: Full Glass Coverage. Sometimes called a "zero-deductible glass option," this rider completely waives your deductible for any glass repair or replacement claim.

This is a huge perk. If you have full glass coverage and a rock cracks your windshield, the insurance company will typically pay 100% of the replacement cost. You owe nothing out-of-pocket. It’s an incredibly valuable option, especially if you live in an area where road debris is common.

Broken windows are a huge part of the global auto insurance market, which was valued at around USD 838.05 billion and is expected to nearly double by 2033. That's a big reason why insurers offer these specialized glass options. In fact, industry data shows that about 85% of U.S. drivers carry comprehensive plans that cover their vehicle's windows. You can find more data on the auto insurance market's growth over at Straits Research.

Making Sense Of Your Insurance Deductible

So, you've confirmed you have the right coverage—that's a great first step. But before you pick up the phone to call your insurance agent, there's a big question you need to answer: Is filing a claim for that broken window actually worth it?

This is where your deductible comes into play. Think of it as your share of the repair bill. It's the amount of money you have to pay out-of-pocket before your insurance policy kicks in to cover the rest. If your policy has a $500 comprehensive deductible, for example, you're on the hook for the first $500 of any approved claim.

This simple number is the key to your decision. You need to weigh the repair estimate against your deductible to figure out if getting insurance involved makes financial sense or if you're better off just handling it yourself.

The Core Financial Calculation

Let’s run through a quick, real-world scenario. Imagine you walk out to your car and find your passenger-side window has been smashed. You get a quote from a local glass shop, and they tell you it’ll cost $350 to replace.

You pull up your insurance policy and see you have that $500 comprehensive deductible.

In this case, the math is pretty clear. Since the repair cost of $350 is less than your $500 deductible, your insurance company won't pay a dime. You'd be responsible for the full cost either way, so filing a claim would only put an unnecessary mark on your policy record.

The rule of thumb is simple: If the repair bill is less than your deductible, paying out-of-pocket is almost always the smarter choice.

But let's flip the numbers. If that same shattered window was going to cost $800 to fix, the story changes completely. You would pay your $500 deductible, and your insurer would cover the remaining $300. Now, filing a claim saves you a good chunk of cash.

To help visualize this, here’s a quick guide to help you decide.

Claim Or Pay Out-Of-Pocket Decision Matrix

Repair Cost Estimate | Your Deductible | Recommended Action | Reasoning |

|---|---|---|---|

$400 | $500 | Pay Out-of-Pocket | The repair cost is below your deductible, so insurance won't contribute. |

$500 | $500 | Pay Out-of-Pocket | Filing a claim provides no financial benefit and just adds to your claim history. |

$950 | $500 | File a Claim | Your insurer covers $450, offering significant savings. |

$600 | $1,000 | Pay Out-of-Pocket | The repair cost is well under your high deductible. |

This table simplifies the decision, but always remember to factor in the potential long-term effects of filing a claim.

Zero-Deductible States And Special Rules

Now, things can get a little different depending on where you live. A few states—like Florida, Kentucky, and South Carolina—have laws that often lead to insurers offering zero-deductible windshield replacements.

If you're in one of these states and have comprehensive coverage, you might not pay anything to get your windshield fixed or replaced. It's a fantastic perk, but keep in mind it usually only applies to the front windshield. A shattered side or rear window would likely still fall under your standard deductible.

Weighing The Impact Of Claim Frequency

Your decision isn't just about the immediate math; you have to think long-term, too. Insurance companies keep a close eye on how often you file claims, even for no-fault incidents like a rock chip.

While a single glass claim is unlikely to send your rates soaring, a pattern of them can make you look like a higher risk. Data from the Insurance Research Council shows that drivers who file two or more auto glass claims in three years can see their premiums jump by an average of around 15%. For more on how insurers view claim frequency, you can read additional research on auto insurance trends.

This makes it even more important to be strategic, especially for smaller repairs. If you're not sure what your repair might cost, our guide on how much a car window repair costs can give you a solid estimate to work with. It's all about balancing the immediate savings against any potential rate hikes down the road.

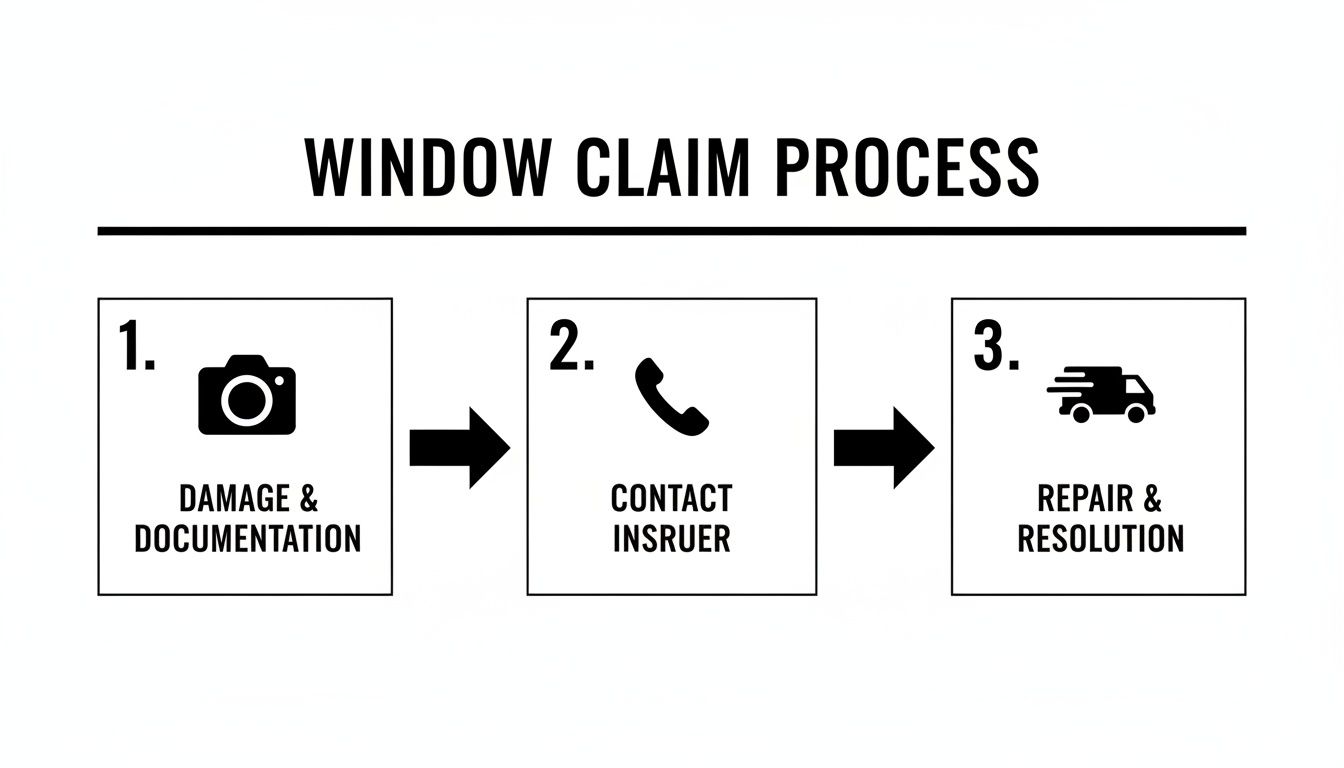

How To File A Broken Window Claim The Right Way

Finding your car with a smashed window is a gut-punch, but getting it fixed doesn't have to be another headache. Filing an insurance claim is actually pretty straightforward once you know the playbook. Let’s walk through it.

First things first, before you even think about making a call, document the damage. Seriously. Grab your phone and take pictures of everything from every conceivable angle. Get close-ups of the shattered glass, but also pull back for wider shots of the whole car and the surrounding area. This visual proof is gold for your claim.

If you suspect a break-in or vandalism, your next call is to the police. A police report isn't just a formality; it's official proof for your insurance company about what happened. When you’re dealing with deliberate damage, knowing how to navigate the system is critical. For a closer look at that process, this guide on winning your vandalism insurance claim offers some great advice on presenting your case effectively.

Contacting Your Insurance Provider

With photos saved and a police report number in hand (if you got one), it's time to loop in your insurer. Most companies give you a few easy ways to get the ball rolling:

Fire up their mobile app: This is often the fastest way to start a claim right from your phone.

Log in to their website: Their online portal will walk you through all the necessary steps.

Call the claims hotline: Sometimes, it’s just easier to talk to a real person.

Make sure you have your policy number handy. You’ll need to explain what happened, and the claims agent will confirm you have comprehensive coverage and go over your deductible. From there, they'll tell you what's next for getting the window replaced.

The Smartest Way To Handle The Repair

Here’s a tip that will save you a world of time and hassle: you don't have to use the repair shop your insurer suggests. You have the right to choose, and picking a mobile expert like Auto Renu can completely change the experience.

Choosing a mobile glass service that already works with your insurance company means you can skip all the annoying administrative work. These pros handle the claim and paperwork for you through a process called direct billing.

Honestly, this is the path of least resistance. The mobile repair company verifies your coverage, talks to the insurance adjuster, and sends the bill straight to them. You just cover your deductible—and sometimes with glass claims, there isn't one. The whole process is simplified, getting your car secure and back in action much faster.

This direct partnership essentially takes you out of the middle. You're no longer playing phone tag between the shop and the insurer. You just book the appointment, and a technician comes right to your home or office to do the work. It’s a massive convenience that gets you back to your life without missing a beat.

Will A Glass Claim Increase Your Insurance Rate?

This is the million-dollar question, isn't it? It's the one thing that stops most people from even thinking about using their insurance for a broken window. You're worried that filing one small claim will send your rates through the roof.

It’s a totally valid concern, but the answer isn't a simple yes or no. Whether your premium goes up really depends on the type of claim and, more importantly, how often you file.

Generally speaking, a single comprehensive claim for a broken window is unlikely to cause a big jump in your insurance rate. Insurers put claims into different buckets, and a comprehensive claim is viewed very differently than an at-fault collision. A collision claim suggests a driving error, which signals risk. A comprehensive claim for a random rock chip or vandalism? That’s usually considered a "no-fault" incident—just plain bad luck.

The Difference Between No-Fault And At-Fault Claims

Think of it from the insurer's perspective. An at-fault collision claim points directly to your driving habits. Because you were responsible, the insurance company sees you as more likely to be in another accident, and they adjust your rate to match that higher risk.

A comprehensive claim, on the other hand, is for things completely out of your control. You didn't ask a thief to smash your window or summon a hailstorm to damage your windshield. Since these events say nothing about your skills behind the wheel, insurers are much more forgiving. A single glass claim rarely flags you as a problem client.

This flowchart breaks down the simple, three-step journey for handling a window claim, from discovery to getting it fixed.

The key takeaway is that the process is designed to be pretty straightforward, moving from documentation to professional repair without a lot of hassle.

Why Claim Frequency Matters More

While a single claim is usually no big deal, the real red flag for insurers is claim frequency. Filing multiple claims in a short time starts to look like a pattern, even if they're all small, no-fault incidents.

One claim in three years: You’re probably in the clear. It's unlikely to have any real impact on your rate when you renew.

Two claims in three years: This might trigger a small increase, but it depends on your insurance company and where you live.

Three or more claims in three years: Now you’re more likely to see a noticeable premium hike at renewal time.

Insurers are in the business of managing risk. A history of frequent claims—no matter how small—suggests that future claims are more likely, and they may adjust your premium to offset that potential cost.

This is why it pays to be strategic. If a repair costs just a little more than your deductible, paying out-of-pocket can be the smarter move. It protects your claims-free history and could keep your long-term costs down. The goal is to use your insurance as a safety net for major expenses, not as a maintenance plan for every little thing.

So, Who Should Actually Fix Your Glass?

Once you've sorted out the insurance side of things, it's time to get the repair done. You could spend half your day driving to a traditional body shop, or you can have a mobile auto glass specialist come right to you. For most people, it's a no-brainer—this is the modern, hassle-free way to handle a broken window.

The convenience is huge. A technician shows up wherever you are—at home, at the office, you name it. They have everything they need to do a full, professional-grade replacement right there in your driveway. What used to be a major chore becomes something that just happens in the background of your day.

Don't Forget About Your Car's Brain: ADAS Recalibration

Here’s something you absolutely can't overlook with modern cars. Many vehicles are packed with Advanced Driver-Assistance Systems (ADAS). These are the high-tech safety features—like lane-keeping assist and automatic braking—that rely on cameras and sensors mounted directly onto your windshield.

If you replace the windshield, that entire system has to be perfectly recalibrated. If you skip this, your safety features could malfunction or fail completely when you need them most.

Think of it this way: the windshield is the "eye" of your car's safety system. If it's not looking in exactly the right direction, your car can't react properly. A qualified mobile technician ensures those eyes are reset to factory-perfect standards, which is non-negotiable for road safety.

The good news is that your insurance will almost always cover the cost of recalibration as part of the windshield claim. You just have to make sure you’re using a pro who knows how to do it right.

Making the Insurance Part Effortless

This is where a good mobile service really shines. The best companies have deep experience working with all the major insurance carriers. They know the ins and outs of the claims process and can essentially take the paperwork off your plate.

They do this through something called direct billing, where the repair company sends the invoice straight to your insurance provider. For you, this means:

No Big Out-of-Pocket Costs: You’ll typically only be responsible for your deductible, if you have one. The rest is handled behind the scenes.

Zero Paperwork Headaches: The specialist takes care of all the claim forms and documentation for you.

Quicker Turnaround: Their established relationships with insurers often mean faster approvals, so you can get the work done sooner.

This approach connects all the dots, giving you a high-quality, safe repair without the typical runaround. To see exactly how this works from start to finish, check out our guide on mobile automotive glass repair. It’s all about turning a stressful problem into a simple fix and getting you back on the road safely.

Got Questions About Car Window Insurance? We've Got Answers.

When a rock chips your windshield or a thief smashes your side window, the first thought is often, "Is this covered?" It’s a common source of confusion, but we’re here to clear things up. Let's walk through some of the most common questions drivers have about their auto glass and insurance.

Think of this as your go-to cheat sheet for handling any window damage that life throws your way.

Will My Insurance Cover a Window Smashed During a Break-In?

Yes, but only if you have comprehensive coverage. This is the part of your policy that handles non-accident-related damage, like theft, vandalism, or falling objects. It's designed for exactly this kind of situation and will cover the cost of replacing the glass.

Here’s a critical point to remember, though: your car insurance fixes your car, not your stolen stuff. If a thief grabs a laptop or a purse from inside, you’ll need to file a separate claim with your homeowners or renters insurance to get those items covered.

Is It Cheaper to Repair a Chip Instead of Replacing the Whole Windshield?

Absolutely, and it's not even close. Repairing a small chip is always the faster, more affordable option. In fact, insurance companies love when you choose to repair.

To encourage you to fix a small chip before it becomes a giant crack, many insurers will completely waive your comprehensive deductible. That means you could get the repair done without paying a single dime out of pocket.

Jumping on a small chip right away saves everyone a headache. It prevents a simple fix from turning into a costly full windshield replacement down the road.

What Happens If Another Driver Broke My Window in an Accident?

If another driver caused the accident, their insurance policy pays for the damage to your car, including the broken window. The specific coverage that kicks in is their property damage liability insurance.

You'll file a claim directly against their policy, not your own. The best part? You won't have to pay your own deductible. This is why it’s so important to exchange full insurance details with the other driver right at the scene.

Will Insurance Pay to Re-Tint My New Window?

Usually, no. Standard auto policies are designed to bring your vehicle back to its factory-original condition. That means they'll pay for the replacement glass itself, but not for aftermarket add-ons like window tint.

The one exception is if you've paid for an optional endorsement on your policy, often called "custom parts and equipment" (CPE) coverage. This extra coverage can help pay to re-tint the new window. It’s always smart to review your policy documents or just call your agent to see exactly what’s included.

Dealing with insurance for a broken window shouldn't add to your stress. At Auto Renu Auto Glass LLC, we've built our business on making this process easy. We work directly with all major insurance providers, handling the direct billing and expert ADAS recalibration so you can get back on the road. For fast, professional mobile service you can trust, visit us at https://www.autorenu911.com.