Cracked Windshield Repair Insurance Guide

A guide to cracked windshield repair insurance. Learn how comprehensive coverage works, how to file a claim, and what to expect from your policy.

Nov 4, 2025

generated

cracked windshield repair insurance, auto glass coverage, car insurance claims, windshield repair, zero deductible glass

It's a sound we all know and dread: the sharp crack of a rock hitting the windshield. That gut-sinking feeling is universal, but what comes next doesn't have to be a headache. If you have the right insurance, the fix can be surprisingly straightforward and affordable.

The key player here is usually comprehensive auto insurance. This is the part of your policy that covers damage from things other than a collision, and a rock chip is a classic example. The best part? Many insurers offer a very low—or even zero—deductible for windshield repairs.

How Insurance Handles Your Cracked Windshield

When road debris leaves its mark on your glass, your mind probably jumps straight to the cost. The good news is, if you have comprehensive coverage, you’re in a much better spot than you might think. This is your safety net for all the random, unexpected stuff life throws at your car.

Think of comprehensive coverage as your protection against "acts of God" or just plain bad luck. It typically covers:

Falling objects (like that pesky rock kicked up on the highway)

Vandalism

Hail and other severe weather

Collisions with animals

A cracked windshield nearly always falls under this umbrella, not your collision coverage. That’s a critical distinction because comprehensive deductibles are often significantly lower than collision deductibles.

A Look at State Laws and Zero-Deductible Perks

A handful of states take driver safety a step further. In places like Florida, Kentucky, and South Carolina, specific laws mandate zero-deductible windshield repair or replacement for anyone with comprehensive coverage.

If you're lucky enough to live in one of these "full glass" states, you can get your windshield fixed without paying a dime out of pocket.

The thinking behind these laws is pretty simple: a clear, undamaged windshield is non-negotiable for safety. Legislators want to remove any financial reason a driver might put off a crucial repair, which could impact their visibility or even the car's structural stability. To get a better sense of how this works, you can explore professional windshield repair services and see how they coordinate with insurance providers.

A lot of people don't realize this, but your windshield isn't just a window. It can provide up to 60% of your vehicle's cabin strength in a rollover crash. Putting off a repair to avoid a deductible is a serious gamble with your safety.

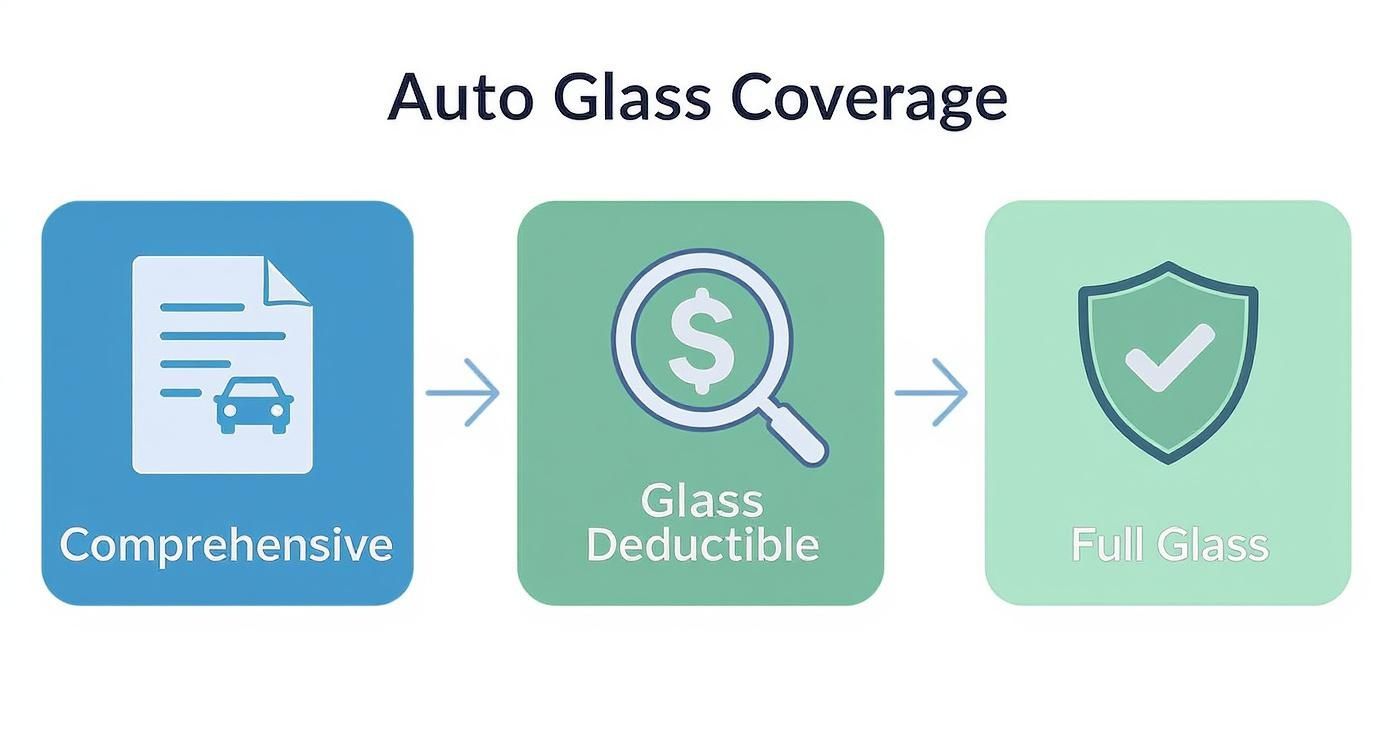

Finding Out What Your Policy Covers

So, how do you know if you have this perk? The quickest way is to pull out your insurance policy's declaration page.

Scan it for terms like "Comprehensive Deductible," "Glass Deductible," or the golden phrase, "Full Glass Coverage." Sometimes, this is an optional add-on (or "rider") that you might have selected for a few extra bucks on your premium.

If the paperwork feels like gibberish, don't sweat it. A quick phone call to your agent or a few taps inside your insurance company's mobile app should give you a clear answer. Knowing the ins and outs of your cracked windshield repair insurance before you need it helps you act fast, save money, and get your car back to being safe. It turns a moment of frustration into a simple, manageable task.

Figuring Out Your Auto Glass Coverage

Let’s be honest, nobody pores over the fine print of their auto insurance policy until they absolutely have to. But when a rock flies up and leaves a spiderweb crack in your windshield, you’ll be glad you know what you’re dealing with. How your insurance handles glass damage all comes down to your comprehensive coverage.

Most people just have their standard comprehensive deductible. Say yours is $500. If a new windshield costs $450, you’re paying for the whole thing yourself. It's a frustrating surprise that makes many drivers wonder why they even bother with the coverage in the first place.

Thankfully, there are better options out there.

The Magic of a Separate Glass Deductible

A much smarter setup, and one that many insurers offer, is a separate, lower deductible just for glass. Instead of that hefty $500 or $1,000 comprehensive deductible applying, your policy might have a special $50 or $100 deductible that only kicks in for glass claims.

This one little detail can change everything.

Scenario A (Standard Deductible): With a $500 comprehensive deductible, a $600 windshield replacement means you pay $500, and the insurance picks up the remaining $100.

Scenario B (Glass Deductible): With a $100 glass deductible, that same $600 job costs you just $100 out of pocket. Your insurer covers the other $500.

Suddenly, a major expense becomes a minor inconvenience. This option usually adds just a few bucks to your monthly premium, but it can save you hundreds when you need it.

What is Full Glass Coverage?

The best-case scenario is what’s known as full glass coverage or a zero-deductible option. This is an add-on, often called a "rider," that completely eliminates your deductible for windshield repair or replacement. In some states, like Florida, Kentucky, and South Carolina, this is actually required by law if you have comprehensive coverage.

For a small bump in your premium, full glass coverage means you pay absolutely nothing out-of-pocket for glass claims. Considering a single windshield on a new car can easily cost over $1,000, this add-on can pay for itself with just one incident.

This is especially true for newer cars. Windshields aren't just simple panes of glass anymore; they’re high-tech hubs for your car's Advanced Driver-Assistance Systems (ADAS). All those cameras and sensors that handle lane-keeping assist and emergency braking are mounted right on the glass.

After a replacement, those systems need to be professionally recalibrated, a service that can tack on hundreds to the final bill. It’s this growing complexity that’s fueling the global windshield service market. Valued at around $15 billion in 2025, the industry is expected to shoot up to nearly $23 billion by 2033, largely because of the technical demands of ADAS-equipped cars. You can read more about the windshield replacement service market trends to see just how much technology is driving up costs.

Is the Extra Cost Worth It?

Whether a glass rider makes sense for you comes down to some pretty simple math and a quick risk assessment. Ask yourself:

How techy is my car? If you have ADAS features, a replacement will be expensive. Full glass coverage becomes almost a no-brainer.

Where do I drive? Lots of highway miles means you’re in the prime-time league for flying rocks and debris. More driving equals more risk.

What's my standard deductible? If your comprehensive deductible is high—say, $1,000 or more—you’re almost guaranteed to pay for a windshield replacement yourself, which makes a rider incredibly valuable.

For most drivers, especially anyone with a car from the last five years, the small monthly cost for a zero-deductible glass rider is a solid investment. It turns a stressful "Can I afford this?" moment into a simple phone call to get it fixed, so your safety is never compromised by cost.

How to File a Windshield Claim Without the Headache

That sinking feeling when you spot a crack spreading across your windshield is bad enough. The last thing you need is a complicated insurance claim process to add to the stress. But here’s the good news: filing a windshield claim is usually much simpler than you’d expect, especially if you’re prepared.

Your first move? Get your ducks in a row. Before you pick up the phone or open an app, grab your insurance policy number. You'll also need the basics on your vehicle—make, model, and year—and the Vehicle Identification Number (VIN). You can usually find the VIN on a small plate on the driver's side of the dashboard, visible right through the windshield.

This infographic breaks down the typical journey, from checking your coverage to getting that fresh new glass installed.

As you can see, it all starts with having the right coverage. From there, it's about understanding your deductible and getting the repair scheduled.

Making the First Contact

So, who do you call first—the auto glass shop or your insurance company? It's a common question, and honestly, there isn't one "wrong" answer. However, my experience shows that starting with your insurer is almost always the most direct route.

Many big insurance carriers have dedicated glass claim hotlines. More often than not, they’ll connect you with a Third-Party Administrator (TPA). These are companies that insurers hire to manage their glass claims from start to finish. They’ll verify your policy, explain your coverage, and schedule the repair with a pre-approved shop in your area. It’s a system designed for efficiency.

Don't be alarmed if your insurance agent transfers you to a company you've never heard of, like Safelite Solutions or Lynx Services. This is completely normal. Think of the TPA as your claim concierge—they handle all the logistics for you.

Of course, you always have the right to choose your preferred repair shop. If you’ve got a local glass specialist you trust, just tell the TPA or your insurance agent. Keep in mind, though, that if the shop isn't in their network, you might have to pay for the repair out-of-pocket and submit the receipt for reimbursement.

Using Technology to Your Advantage

Why wait on hold when you don't have to? These days, you can often bypass the phone call entirely. Nearly every major insurer has a mobile app or online portal that makes filing a claim surprisingly fast. In many cases, it's the quickest way to get the ball rolling.

The digital process is typically very straightforward:

Log into your account on the insurer’s app or website.

Find the claims section and select the option for "Glass" or "Windshield."

Provide the details, confirming your vehicle info and describing the damage—is it a chip or a crack? Where is it located? How big is it?

Schedule the appointment. The platform will usually link directly to a TPA's scheduling system, letting you pick a time and place for the repair. You can often book mobile service to your home or office.

Imagine this: a driver with Geico notices a chip on her way to work. She pulls over, opens the app, and spends three minutes tapping in the details. Before she even gets to the office, she has an appointment booked for a technician to come to her workplace the next day. No hold music, no hassle.

By having your information ready and taking advantage of the digital tools at your fingertips, you can turn a major annoyance into a minor five-minute task and get back on the road safely.

Repair vs. Replace: How Insurers Make the Call

When you report a cracked windshield, your insurance company has a big decision to make: fix the chip or replace the whole thing? This isn't just a coin toss. It's a careful calculation based on safety standards, cost-effectiveness, and years of industry data. Knowing what goes into their decision helps you understand what to expect from your claim.

Let’s be honest, it often comes down to cost. Insurers, like any business, want to keep costs down, and a simple repair is always the cheaper route. We’re talking a difference of hundreds of dollars.

In fact, industry numbers show that nearly 80% of insured windshield damages are repaired, not replaced. A typical repair might run from $50 to $150, but a full replacement can easily cost $300 to over $1,000, especially on newer cars loaded with tech. You can dig deeper into the windshield glass repair market dynamics on 360iresearch.com.

The Key Decision Factors

So, what are the technicians and insurance adjusters actually looking at when they assess your windshield? They're checking the damage against a few clear-cut criteria to ensure any repair is safe and will actually last.

It all boils down to three things: size, location, and type of damage.

Size Matters: The classic rule of thumb is the "dollar bill test." If the entire chip or crack can fit under a dollar bill (which is about six inches long), it’s usually a great candidate for a repair.

Location is Critical: Any damage directly in the driver’s line of sight is a huge concern. Even a perfect repair can leave a tiny distortion, and you don't want anything obstructing your view of the road. In this case, they’ll almost always opt for a replacement.

Type of Damage: A clean, simple chip—what we call a "bullseye" or "star break"—is straightforward to fix. A long, spidering crack is another story. If the crack has spread or reaches the edge of the glass, it has already compromised the windshield’s structural integrity.

Expert Tip: Damage right at the edge of the windshield is almost always a no-go for repair. The edges are high-stress areas, and a crack there can spread quickly, seriously weakening the glass. Replacement is the only safe option.

To make it simple, here’s a quick breakdown of how these factors influence the decision:

Windshield Repair vs. Replacement Decision Matrix

Factor | Favors Repair | Favors Replacement |

|---|---|---|

Size of Damage | Small chip or crack (under 6 inches) | Long crack (over 6 inches) or multiple chips |

Location | Outside the driver's direct line of sight | Directly in the driver's line of sight |

Damage Type | Simple "bullseye" or "star" break | Complex "spiderweb" crack or deep pit |

Edge Proximity | Damage is well away from the windshield edge | Crack extends to or originates from the edge |

ADAS Presence | Damage is far from camera/sensor mounts | Damage is near or over ADAS components |

Ultimately, this table shows that while a repair is often possible, any factor that compromises driver visibility or the windshield's structural role will push the decision toward a full replacement.

The ADAS Complication

With modern cars, there's another major factor at play: Advanced Driver-Assistance Systems (ADAS). These are the brains behind features like automatic emergency braking and lane-keep assist, and their cameras and sensors are often mounted directly to the windshield.

If the damage is anywhere near these sensitive components, a repair is usually off the table, even if it’s a tiny chip. The system needs a flawless glass surface to work correctly, so a replacement becomes necessary.

What's more, after a windshield replacement, the ADAS system has to be professionally recalibrated. This is a meticulous process to ensure the cameras are aimed perfectly and your safety features function exactly as they should. Insurers know this is a critical safety step and will cover the recalibration cost as part of the claim. You can learn more about what this entails by reading about the windshield replacement process on our site.

At the end of the day, while your insurer is watching the bottom line, safety is what truly dictates the outcome. They'll follow established guidelines to make a call that protects you, your vehicle, and their own liability.

How to Keep Your Out-of-Pocket Costs Down

Even if you have fantastic insurance, nobody enjoys paying more than they absolutely have to. When it comes to a cracked windshield, being proactive is the secret to keeping your money in your pocket. A few smart, quick moves can be the difference between a free repair and a bill that stings.

The best piece of advice I can give is this: act fast on small chips. That tiny starburst from a rock on the freeway might seem like no big deal, but it's a ticking time bomb. All it takes is a hot day, a cold night, or a bumpy road for that little chip to spread into a long crack that can’t be fixed.

Get the Most Out of Your Zero-Deductible Policy

If you have a zero-deductible or full glass coverage policy, using it is a no-brainer. This is exactly why you pay that small extra premium every month. Don't think twice about filing a claim for a minor chip—trust me, your insurance company would much rather pay for a quick, cheap repair now than a full, expensive replacement later.

Sticking with your insurance company’s approved network of auto glass shops is another great way to avoid surprise costs. These "in-network" shops have already agreed on pricing with your insurer, which makes the whole billing process seamless. You just get the work done, and they handle the paperwork directly with your provider.

You absolutely have the right to choose an out-of-network shop, but just be ready for a bit more legwork. Your insurer is only required to pay what they consider a "reasonable and customary" rate. If the shop you pick charges more, you'll probably have to cover the difference yourself.

Why In-Network Shops and ADAS Matter

For newer cars, using an approved shop is especially critical. If your windshield needs to be replaced, your car's Advanced Driver-Assistance Systems (ADAS)—like lane-keep assist and automatic braking—have to be recalibrated to work correctly. In-network shops are vetted to make sure they have the right tools and training for this crucial safety step. Our guide on ADAS windshield calibration dives deeper into why this process is so important for your safety.

Following this advice ensures your repair is not only covered but also done right, keeping you safe without an unexpected bill.

What About Those DIY Repair Kits?

You’ve probably seen them on the shelf at the auto parts store: do-it-yourself windshield repair kits. They look tempting, promising a fast and cheap fix for that little chip. Before you go that route, though, it’s really important to understand their limitations.

The market for these kits is huge, valued at an estimated $1.5 billion in 2025. They usually come with a small tube of resin and some curing strips, designed for the most minor, simple chips. You can read more about the windshield repair kit market on archivemarketresearch.com.

Here’s the catch: while a kit might work on a tiny, clean bullseye chip, a botched DIY repair often makes it impossible for a professional to properly fix the damage later. If the resin doesn't cure correctly, it blocks professional-grade materials from getting in and bonding to the glass.

Even worse, many insurance companies will refuse to cover a replacement if they see the damage was made worse by a failed DIY attempt.

Before you grab that kit, ask yourself this:

Could the repair be free? If you have full glass coverage, a professional will fix it for nothing out of pocket.

How bad is the damage? If it's anything more than a tiny, simple chip, leave it to the pros.

Are you ready to risk the full replacement cost? A failed DIY job can quickly turn a free repair into a $1,000+ expense.

Common Questions About Windshield Insurance Claims

Let's be honest, even when you know the steps, dealing with insurance can feel like a minefield of "what-ifs." It's one thing to file the claim, but it's another to feel confident you're making the right moves.

I've been in this business a long time, and I've heard every question imaginable. Here are straight answers to the most common concerns that pop up, so you can handle your claim without any second-guessing.

Will a Windshield Claim Make My Insurance Rates Go Up?

This is the big one, isn't it? The fear of a rate hike keeps a lot of people from even making the call. But here’s some good news: in almost every case, filing a single glass claim under your comprehensive coverage will not raise your insurance premiums.

Why? Because insurers see it as a no-fault situation. You didn't cause that rock to fly up from a dump truck and hit your windshield. It's considered bad luck, not bad driving. It doesn’t signal that you’re a risky driver like an at-fault collision would.

The only time you might run into trouble is if you're filing multiple glass claims in a very short time frame—say, three claims in less than a year. A pattern like that might flag your account for a review and could potentially lead to a higher rate or the loss of a claims-free discount. When in doubt, a quick call to your agent can clear things up.

Can I Pick My Own Repair Shop?

Absolutely. It's your car, and you have the right to choose who works on it. Your insurance company can't legally force you to use a specific shop. They will, however, have a list of "preferred" or "in-network" shops they’ll strongly recommend.

There are some real perks to using one of their preferred partners:

Direct Billing: The shop sends the bill straight to the insurer. You typically only handle the deductible, if you even have one.

A Smoother Process: These shops know the insurer's system inside and out, which usually means less paperwork and a faster turnaround.

Pre-Approved Pricing: The labor rates are already negotiated, so there are no surprise charges.

If you have a trusted local technician you'd rather use, that's perfectly fine. Just know that you might have to pay the full bill upfront and wait for your insurance company to reimburse you. Also, be aware that your insurer will only cover what they consider a "reasonable and customary" rate. If your shop charges more, you might have to pay the difference out of pocket.

Choosing your own trusted local technician is your right as a consumer. Just be prepared for a bit more paperwork and a quick conversation with your insurer to understand how they will handle the reimbursement.

Is ADAS Recalibration Covered by My Insurance?

If you drive a newer car, this is a non-negotiable question. Those advanced safety features—like lane-keeping assist, adaptive cruise control, and automatic emergency braking—all depend on cameras and sensors mounted to your windshield. They’re part of your ADAS (Advanced Driver-Assistance Systems).

After a windshield is replaced, these systems must be recalibrated to work correctly. It's not optional; it's a critical safety step. Thankfully, virtually all comprehensive insurance policies cover the cost of recalibration. They see it for what it is: an essential part of a safe, complete windshield replacement.

Considering recalibration can add a few hundred dollars to the final bill, having that insurance coverage is more important than ever for modern vehicles.

What if My Windshield Claim Is Denied?

Getting a denial notice is incredibly frustrating, but it's not the end of the road. Your first move should be to ask the adjuster for a detailed explanation in writing. You can't fight a denial if you don't know the exact reason behind it.

Most denials happen for a few common reasons:

You don't actually have comprehensive coverage on your policy.

The damage happened before your current policy was active.

The cause of the damage wasn't a covered event (like a shoddy installation from a previous repair).

Once you have their reason, pull out your policy documents and see if their explanation holds up. If you spot a mistake or disagree with their interpretation, you have the right to file an appeal directly with the insurance company. Make sure you back it up with evidence like photos, repair estimates, and your policy documents.

If that doesn't work, your last resort is to file a complaint with your state's department of insurance. They will step in and investigate the claim on your behalf.

When you need fast, reliable service for your cracked windshield, Auto Renu Auto Glass LLC is here to help. We work with all insurance providers to make your claim process smooth and stress-free. Get a free estimate and experience our top-rated mobile service at https://www.autorenu911.com.