Does Insurance Cover Windshield Replacement? Find Out Now

Wondering if insurance covers windshield replacement? Discover how your policy, deductibles, and tech impact your auto glass claim today!

Oct 10, 2025

generated

insurance covers windshield replacement, windshield replacement, auto glass claim, comprehensive insurance, car insurance deductible

That sickening "thwack" of a rock hitting your windshield is a sound every driver dreads. Your first thought is probably about the hassle and the cost. The good news? Yes, insurance often covers windshield replacement, but it all hinges on having the right type of coverage.

Your Guide to Windshield Replacement Coverage

That crucial piece of your policy is called comprehensive coverage. This isn't your standard liability or collision insurance; think of it as your car's protection against all the random, non-accident stuff that can happen.

A cracked windshield is more than just a cosmetic issue—it can be a serious safety hazard. So, when road debris strikes, the big question is always, "Am I covered?" The answer is usually found in the fine print of your comprehensive plan.

To give you a clearer picture, here’s a quick breakdown of how different policies typically handle glass damage.

How Your Insurance Handles Windshield Damage

Coverage Type | Covers Windshield Replacement? | How It Usually Works |

|---|---|---|

Comprehensive | Yes | This is the main coverage for non-collision damage. You'll likely have to pay your deductible first. |

Full Glass Coverage | Yes | An optional add-on to comprehensive that often waives the deductible for glass repair or replacement. |

Collision | No | Only covers damage from an accident with another vehicle or object. |

Liability Only | No | Only covers damage you cause to others; it offers no protection for your own vehicle. |

As you can see, comprehensive coverage is your best friend when it comes to a damaged windshield.

What Comprehensive Typically Handles

Comprehensive insurance is designed for a whole host of incidents that are completely out of your control. For your windshield, this usually includes:

Road Debris: This is the number one culprit. Think rocks, gravel, and other bits kicked up by trucks on the highway.

Weather Events: Hail is a notorious glass-breaker, but falling tree branches during a storm also count.

Vandalism or Theft: If someone intentionally smashes your glass or breaks it during a break-in.

But having the coverage doesn't automatically mean you get a free pass. This is where your deductible comes into play. The deductible is simply the amount of money you have to pay out-of-pocket before your insurance company starts chipping in.

Let’s say a brand-new windshield costs $800 and your comprehensive deductible is $500. You would pay the first $500, and your insurer would cover the remaining $300.

There’s a fantastic exception to this rule called "full glass coverage." It's an optional add-on that many insurers offer. With this, your deductible for glass-only claims is often waived completely, making a repair or replacement much easier on your wallet.

It's also worth noting that some states actually have laws requiring insurance companies to offer zero-deductible glass coverage. It pays to know the rules where you live.

Understanding how comprehensive coverage, deductibles, and full glass options fit together puts you in the driver's seat. For a closer look at what the process involves, you can learn more about professional windshield replacement services and see how they work directly with insurance providers. Having this knowledge will help you handle your next claim like a pro.

How Comprehensive Coverage Really Works

So, you want to know if insurance covers windshield replacement? The short answer is yes, but it all comes down to a specific part of your policy: comprehensive coverage.

It helps to think of comprehensive insurance as your car's "bad luck" protection. It’s totally separate from collision coverage, which is for when you actually hit another car or an object. Comprehensive steps in for the random, unpredictable stuff that’s completely out of your control. We’re talking about a tree branch falling on your roof, hail damage during a storm, or that classic scenario—a rock getting kicked up on the highway and leaving a nasty crack in your windshield.

But here’s the crucial part you need to understand to actually use it: your deductible.

Decoding Your Comprehensive Deductible

Your deductible is simply the amount of money you have to pay out of your own pocket for a repair before your insurance company starts paying. It's your piece of the bill.

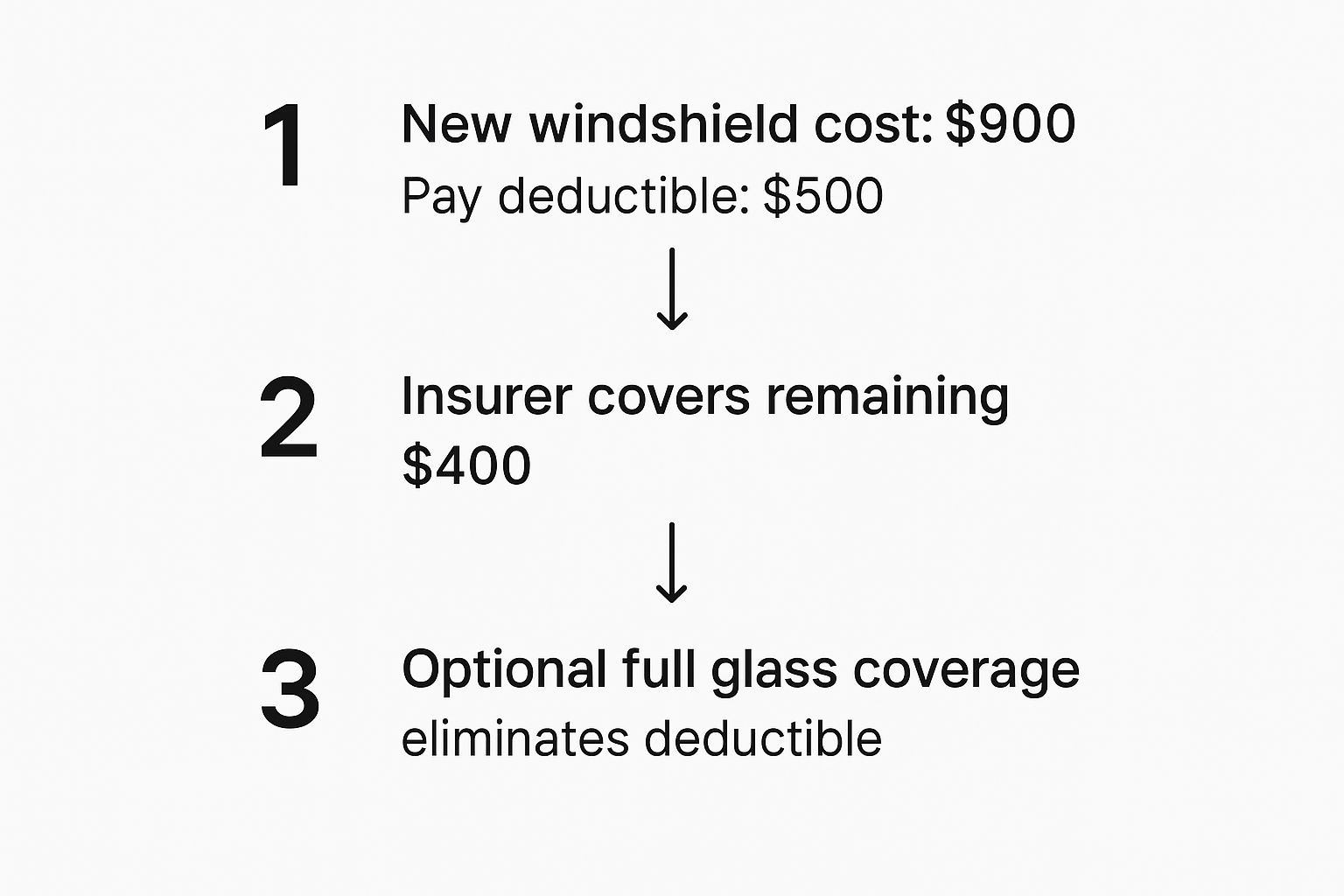

Let's walk through a real-world example. Say your policy has a $500 comprehensive deductible, and getting a new windshield is going to cost $900.

Here's how that plays out:

Total Replacement Cost: $900

Your Share (Deductible): You pay the first $500.

Insurer's Share: Your insurance company picks up the remaining $400.

It’s a straightforward split. This is exactly what the image below illustrates—how you and your insurer share the cost.

The visual makes it crystal clear how that bill gets divided. But what if you didn't have to pay that $500 at all?

The Zero-Deductible Option: Full Glass Coverage

This is where a popular add-on called full glass coverage comes into the picture. For a small increase in your premium, you can often add this rider to your comprehensive policy, and it typically drops your glass-only deductible all the way down to $0.

With full glass coverage, that same $900 windshield replacement wouldn't cost you a dime out of pocket. Your insurance would cover the entire thing.

This add-on is a game-changer because it means you won't hesitate to fix a damaged windshield right away, keeping your car safe. It’s a big reason why the global automotive windshield market, which hit $29.74 billion in 2023, keeps growing—insurance makes replacement accessible. You can dig into the market trends and see how insurance plays a role over on Fortune Business Insights.

In fact, some states legally require insurance companies to offer a zero-deductible windshield option. It’s always smart to check your state’s rules and take a close look at your own policy to see if you can add this valuable protection.

How to Navigate the Auto Glass Claim Process Step by Step

So, you’ve confirmed your insurance covers windshield replacement. That's a huge relief. But now you have to actually file the claim, and that part can feel a little daunting. The good news? It’s usually a pretty simple process once you know what to do.

Think of it as a clear roadmap to get you from a cracked windshield back to a safe, clear view of the road ahead.

Filing a claim really doesn't have to be a headache. Just follow a few logical steps to make sure nothing gets missed and the whole thing moves along quickly.

Your Action Plan for a Smooth Claim

That moment you see a crack spread across your windshield is frustrating. Your first instinct might be to panic, but the best thing you can do is take a breath and take action. If you're driving, pull over safely and take a look.

Here's a simple, step-by-step guide to get you through it:

Assess and Document the Damage: Before you do anything else, grab your phone. Take clear pictures of the chip or crack from a few different angles. It's also smart to jot down the date, time, and where you were when the damage happened. This is your proof.

Review Your Insurance Policy: Hop on your insurer's app or website and pull up your policy. You're looking for two things: confirmation that you have comprehensive coverage and what your deductible amount is. Knowing this upfront prevents any financial surprises later.

Contact Your Insurance Provider: This is where you officially kick off the claim. Most insurance companies have a dedicated phone number just for auto glass, but the fastest route is often through their mobile app.

Pro-Tip: When you talk to your insurer, ask if they partner with a "preferred network" of auto glass shops. Going with one of their recommended shops can make your life a lot easier, as they usually bill the insurance company directly.

Choosing a Shop and Getting the Work Done

Once your claim is filed, you’ll get a claim number. Guard that number! It’s the key to everything that comes next. Now it's time to get the actual work done.

These final steps are just as crucial for a stress-free experience:

Select a Qualified Auto Glass Shop: You almost always have the right to choose your own repair shop. Find a reputable company that knows how to handle insurance claims. This is especially important if your car has advanced driver-assistance systems (ADAS), which require special calibration after a replacement.

Schedule the Service: Give your chosen shop the claim number. They'll use it to verify your coverage directly with the insurance company and get you on their schedule. Many shops, like us, even offer mobile service, so we can come to your home or office.

Handle Your Deductible: If your policy has a deductible, you'll pay that amount directly to the glass shop after the job is done. If you have full glass coverage or you're just getting a small chip filled, you might not have to pay anything at all. In fact, catching those small chips early is often the smartest move. You can learn more about the benefits of timely windshield repair to see if that's a better option for you.

Why Modern Windshields Complicate Insurance Claims

Long gone are the days when a windshield was just a simple piece of glass. Today, it’s a high-tech command center for your car's most important safety features, and that completely changes the game when it's time for a replacement.

The real difference-maker is something called Advanced Driver-Assistance Systems (ADAS). These are the smart features that help keep you safe on the road—think lane-keeping assist, adaptive cruise control, and automatic emergency braking. The sophisticated cameras and sensors that make all this possible are often mounted directly to your windshield.

Because of this, you can't just swap out a cracked windshield for a new one anymore. There's a crucial second step that’s absolutely essential for your safety.

The Non-Negotiable Step of ADAS Recalibration

After a new windshield goes in, those ADAS cameras must be recalibrated.

Think of it this way: replacing the glass without recalibrating is like getting new prescription eyeglasses where the lenses aren't centered correctly. You might be able to see, but everything will be just a little bit off. On the road, that tiny margin of error can be incredibly dangerous.

Recalibration makes sure the system's cameras and sensors are aimed perfectly, so they can accurately judge distances, see lane markings, and spot obstacles. If you skip this, your car’s safety features could fail right when you need them most.

Failing to perform an ADAS recalibration can lead to system malfunctions, causing anything from annoying false warnings to a complete failure of the automatic braking system. This isn't just a recommendation; it's a critical safety requirement.

The need for this specialized service is exploding. In 2022, the U.S. market for ADAS calibrations was already worth $959 million, with nearly 3.8 million windshield replacements needing it.

How This Affects Your Insurance Claim

This extra layer of technology directly impacts the cost and complexity of any windshield replacement claim. A once-simple glass swap now requires high-tech equipment and technicians with very specific training.

This is exactly why comprehensive coverage is more valuable than ever. The higher costs make paying for a new windshield out-of-pocket a much bigger financial hit than it used to be.

Here’s why this all matters for your insurance claim:

Increased Costs: The recalibration process alone can add hundreds of dollars to the final bill, pushing the total cost far above a typical deductible.

Specialized Technicians Required: Not just any glass shop can do this. You need a facility with the right training and equipment to perform an ADAS recalibration correctly.

Insurance Verification: Insurers know how important this is. They will often want proof that a certified shop is handling the calibration to the manufacturer's exact standards.

Getting a handle on this process is the key to a safe and successful repair. You can learn more about what's involved in our guide on the essentials of ADAS windshield calibration. It’s a vital step you can't afford to skip.

Will a Windshield Claim Raise Your Insurance Rates?

https://www.youtube.com/embed/wgiEyVc73s0

It's the one question that keeps drivers from using the insurance they pay for every month. Let's get right to it: the good news is that a single, isolated windshield claim will almost never raise your insurance rates.

Insurers see a rock chip from road debris as a no-fault incident. They get it—you can’t dodge a pebble kicked up by a truck on the freeway. This is why a comprehensive glass claim is treated completely differently than an at-fault accident you caused.

Filing one claim is highly unlikely to move the needle on your premium. But, like most things with insurance, there are a few details to keep in mind.

What Could Affect Your Rates?

While one claim is usually no big deal, insurers are always looking at the bigger picture of your claims history. If you file multiple comprehensive claims in a short time—say, three glass replacements in two years—it might cause them to take a closer look at your policy.

At the end of the day, insurance is a game of risk. A pattern of frequent claims can signal that you're a higher-risk driver, which could lead to a rate increase when your policy renews.

It also really matters how the windshield broke.

A Standalone Glass Claim: This is your classic rock chip or a stress crack that appears out of nowhere. It’s a straightforward, no-fault comprehensive claim and the kind that rarely impacts your premium.

Glass Damage from a Collision: If your windshield shatters because you were in an accident that was your fault, the replacement will be part of the larger collision claim. A claim like this absolutely can raise your rates.

The bottom line is this: feel confident using your comprehensive coverage for a random, one-off windshield replacement. Insurers expect these no-fault, unavoidable events to happen and don't typically penalize you for them.

Your policy is a tool meant to be used. Don't let the fear of a small rate hike stop you from fixing a major safety hazard like a cracked windshield, especially when insurance covers windshield replacement for this very reason.

When to Pay Out of Pocket Instead of Filing a Claim

Just because you have coverage doesn't automatically mean you should file a claim. Sometimes, the smarter financial move is to handle the cost of a new windshield yourself. It can actually save you money and keep your insurance record clean.

Before you dial up your insurance company, take a minute to do some quick math. It's a simple cost-benefit check to see if getting them involved is truly worth it.

Analyzing Your Deductible vs. The Cost

The most obvious reason to pay out of pocket is when the repair cost is less than your deductible. You wouldn't file a claim for something your insurance won't even contribute to.

Here’s when paying yourself makes the most sense:

The Cost is Below Your Deductible: If a new windshield costs $450 but your comprehensive deductible is $500, there's no point in filing. Your policy won't pay a dime until you've covered your $500 portion first.

The Cost is Barely Above Your Deductible: Let's say the replacement is $550 and your deductible is still $500. Filing a claim means you’d pay $500, and your insurer would cover the remaining $50. Is saving $50 worth having a formal claim on your insurance history? For most people, the answer is no.

You Have a High Deductible: If you chose a high deductible—say, $1,000 or more—to keep your premiums low, you'll almost always be better off paying for a standard windshield replacement on your own.

Protecting Your Claims History

This is a big one. Even though a single glass claim usually won't cause your rates to spike, insurers get nervous when they see a pattern of claims.

Think of it from their perspective: a driver who files a claim every year, even for small things, looks riskier than a driver who hasn't filed one in five years.

If you've already had a claim or two in the last few years (for a fender bender or anything else), paying for this windshield yourself is a strategic play. It keeps this minor incident off your record and helps you avoid a potential rate hike when it's time to renew your policy.

Making a calculated choice here is all about using your insurance as the safety net it’s intended to be—for the big stuff—while handling the small stuff yourself when it makes financial sense.

Got Questions About Windshield Claims? We Have Answers.

When you're dealing with a cracked windshield, the last thing you want is to get lost in insurance jargon. Let's clear up some of the most common questions drivers have about the claims process, so you know exactly what to expect.

OEM vs. Aftermarket Glass: What's the Real Difference?

You'll hear two terms thrown around when you need a new windshield: OEM and aftermarket. So, what's the deal?

OEM (Original Equipment Manufacturer) glass is the same stuff your car had when it rolled off the assembly line. It’s made by the same company, to the exact same specifications. Think of it as the brand-name version—a guaranteed perfect fit and match.

Aftermarket glass, on the other hand, is made by a third-party company. It has to meet federal safety standards, and it's often a bit cheaper. But, the quality and fit can sometimes be a mixed bag.

For newer cars with advanced safety features (like lane-keeping assist or automatic braking), using OEM glass is often a must. These systems rely on cameras mounted to the windshield, and the precise clarity and shape of OEM glass are critical for them to work correctly after recalibration. It's always a good idea to check with your installer to see what your policy covers and what your vehicle manufacturer recommends.

Do I Have to Use the Repair Shop My Insurance Company Suggests?

Nope. In most states, the law is on your side—you have the right to choose which auto glass shop does the work. Your insurance company can't legally steer you to a specific place.

That said, most insurance companies have a "preferred network" of shops they've already vetted and trust. Choosing one of these shops usually makes life a lot easier. They often bill the insurance company directly, so you're not stuck with a big out-of-pocket expense.

If you go with a shop that’s not in their network, you might have to pay for the replacement yourself and then submit the receipt to your insurer for reimbursement.

The bottom line? You're in the driver's seat. But for a hassle-free experience with less paperwork, an in-network shop is usually the smoothest route.

What About Small Chips? Does Insurance Cover Those, Too?

You bet. In fact, your insurance company wants you to get those small chips fixed right away.

Repairing a small chip is way cheaper than replacing an entire windshield, which saves them money in the long run. To encourage you to act fast, most insurers will waive your comprehensive deductible if you choose to repair the damage instead of replacing the glass. It’s a true win-win: you avoid paying a deductible, and a tiny chip doesn't get the chance to spread into a giant, vision-blocking crack.

Don't let a cracked windshield compromise your safety. The expert team at Auto Renu Auto Glass LLC handles the entire insurance claim process for you, from paperwork to final installation and ADAS recalibration. Get a free, no-obligation quote today and let us restore your clear view of the road. Visit us online at https://www.autorenu911.com to schedule your mobile service.