Windshield Replacement Insurance Claim: Your Guide to Coverage and Reimbursement

A practical guide to your windshield replacement insurance claim: how to file, get coverage, choose glass, and ensure ADAS recalibration.

Dec 27, 2025

generated

windshield replacement insurance claim, auto glass claim, comprehensive insurance, ADAS recalibration, OEM vs aftermarket glass

Before you even think about calling your insurance company, the single most important step in a successful windshield replacement insurance claim is knowing your coverage. Most glass damage—think flying rocks, falling tree limbs, or storm debris—falls under your policy's comprehensive coverage, not collision. Getting a handle on what's in your policy before you need it saves a world of headaches.

Decoding Your Auto Glass Insurance Coverage

Jumping into a claim without first reviewing your policy is a recipe for frustration. You wouldn't start a road trip without a map, right? Think of your policy documents as the map to a smooth, cost-free replacement. Your first move should be to pull up your policy and get familiar with the specifics of your comprehensive plan.

Comprehensive coverage is your financial safety net for all the random, non-accident stuff that can happen to your car. It covers theft, vandalism, fire, and, most importantly, that stray piece of gravel that just took out your windshield on the highway. This is a critical distinction because comprehensive claims are generally considered "no-fault," so they are far less likely to send your premiums skyrocketing.

Navigating the jargon in your policy can feel like learning a new language. This quick-reference table breaks down the terms you’ll run into when dealing with a glass claim.

Key Insurance Terms for Glass Claims

Term | What It Means for Your Claim | Action Required |

|---|---|---|

Comprehensive Coverage | This is the part of your policy that covers non-collision damage, including your windshield. | Confirm you have this coverage. Without it, the full cost is on you. |

Deductible | The amount you must pay out-of-pocket before insurance kicks in. | Know your exact deductible amount (e.g., $250, $500). |

Full Glass Coverage | An optional add-on that often waives your deductible for glass repair or replacement. | Check your policy for this rider. If you have it, you likely pay nothing. |

OEM Glass | "Original Equipment Manufacturer" glass—made by the same company that made your car's original windshield. | Ask your insurer if they cover OEM parts, as some policies default to aftermarket. |

ADAS Recalibration | The process of realigning the cameras and sensors in your windshield that support safety features. | Verify that your policy covers the cost of this mandatory service. |

Understanding these terms gives you the confidence to speak with your insurer and ensure you're getting everything you're entitled to.

What Is Full Glass Coverage?

Some policies include an add-on called full glass coverage, sometimes known as a "glass waiver." If you have this, you've hit the jackpot. It means your insurance company will likely waive your entire comprehensive deductible for windshield repair or replacement. In other words, you could pay $0 out of pocket.

If you don't have that rider, you're on the hook for your deductible—whether it's $250, $500, or more—before your insurance pays a dime. For a more detailed look, check out our guide on what insurance covers for windshield replacement.

Key Questions for Your Insurer

Once you've reviewed your policy, you'll be ready to talk to your agent or a claims representative. Having a few key questions prepared will prevent any unwelcome surprises down the road.

Deductible: "What is my specific comprehensive deductible for a full windshield replacement?"

Premium Impact: "Will filing a single, no-fault glass claim affect my rates at renewal?"

Shop Choice: "Can I choose my own certified shop, or do I have to use one from your preferred network?"

ADAS Recalibration: "Does my coverage include the cost of recalibrating my car's advanced driver-assistance systems?"

Aftermarket Additions: "My windshield has a car window security film. Is its replacement cost covered?"

Pro Tip: When you make that first call, get a claim number right away. Also, jot down the name of the person you're speaking with. This simple habit creates a clear record and makes any follow-up calls much, much easier.

Getting Your Ducks in a Row Before You File

Let’s be honest, nobody enjoys filing an insurance claim. But a few minutes of prep work upfront can save you a mountain of headaches later. Think of it like this: the easier you make it for the insurance company to say "yes," the faster you'll be looking through a brand-new windshield.

When you call them with all the necessary information in hand, you’re not just another claim number. You’re an organized customer who has a clear, legitimate problem that needs solving. This simple shift in approach can make all the difference.

The Claim-Filing Cheat Sheet

Before you even think about picking up the phone or logging into your insurer’s website, get these details together. Trust me, you'll thank yourself for it.

Your Policy Number: This is your account's main identifier. Have it ready.

Vehicle Identification Number (VIN): This 17-digit number is your car's unique ID. It’s usually visible on a small plate on the driver's side of the dashboard, right where it meets the windshield. It ensures they order the exact right glass for your make and model.

When and Where it Happened: Be specific. "Yesterday around 3:00 PM on I-5 North, just past the bridge" is far more effective than "sometime last week on the highway."

What Caused It: A quick, clear explanation is all you need. Was it a rock kicked up by a semi? A rogue piece of road debris? Hail from that storm on Tuesday? This detail is crucial for classifying the claim under your comprehensive coverage.

Having this stuff ready to go shows the claims handler you mean business and helps them process your request without a lot of back-and-forth.

Here's a pro tip: Don't be vague. Insurance adjusters are trained to look for red flags, and fuzzy details can sometimes cause delays. Sticking to the facts of a clear, no-fault event (like a rock chip) keeps things moving smoothly and is far less likely to affect your future rates.

A Picture is Worth a Thousand Words (and a New Windshield)

You can describe a crack all day long, but nothing beats a clear photo. For an adjuster who might be hundreds of miles away, good pictures are the next best thing to being there. They remove any guesswork and provide undeniable proof of the damage.

Make sure your photos tell the whole story.

Get a close-up: Take a clear shot of the chip or crack. For context, try placing a coin next to it to show the scale.

Zoom out a bit: Take a wider photo that shows where the damage is on the windshield itself. Is it in the driver's line of sight? Near the edge?

Capture the whole car: A picture of your entire vehicle, making sure the license plate is visible, confirms the car's identity and general condition.

This simple set of photos gives the adjuster everything they need to approve your windshield replacement insurance claim, often without needing any follow-up questions. It's the fastest way to get your approval and move on to the repair.

Alright, you've got your photos and policy details in hand. Now it's time to actually kick off the windshield replacement insurance claim. All that prep work is about to make this part a breeze, transforming what could be a headache into a simple to-do list item.

Most insurance companies give you three ways to get this done. You can hop online, pick up the phone, or just call your local agent. Honestly, the "best" way just comes down to what you prefer.

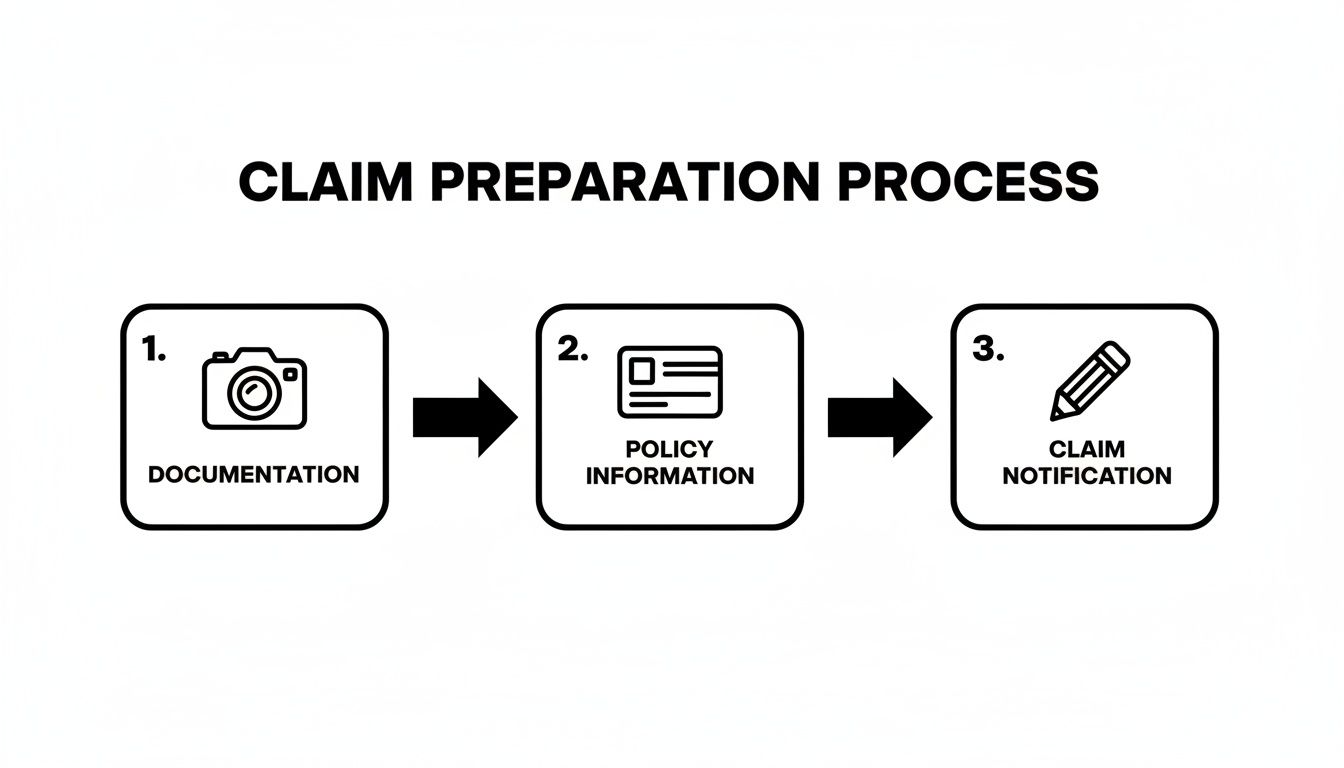

Think of it as a simple, three-part launch sequence: get your proof, have your policy info handy, and then make the official notification.

Nailing this order means you'll have an answer for every question they throw at you, which helps avoid those annoying back-and-forth calls and emails later on.

Filing Your Claim Online

For most people, the fastest path is using the insurance company's website or mobile app. These portals are built to be user-friendly, walking you step-by-step through a few simple forms. You'll punch in your policy number, car details, and a quick summary of what happened before uploading the photos you took.

The biggest win here is that you can do it anytime, day or night. No waiting on hold. The system usually spits out a claim number instantly, which is the golden ticket you need for everything else.

Crucial Takeaway: No matter which method you choose, do not hang up or log out until you have a claim number. This is your reference for everything that comes next—from scheduling the job to getting the bill paid.

Making the Call to Your Insurer

If you'd rather talk to a real person, calling the claims hotline is a great choice. With your notes in front of you, the call can be surprisingly quick. A simple script can keep you focused and make sure you don't forget anything important.

Here’s a no-nonsense example of what to say:

"Hi, I need to open a glass claim using my comprehensive coverage. My policy number is [Your Policy Number]. A rock cracked my windshield on the highway yesterday, and I need a full replacement for my [Year, Make, Model]."

That one sentence gives the rep everything they need to get started. Just be ready to confirm the date, where it happened, and how the damage occurred.

Working Through Your Local Agent

Reaching out to your local agent brings a personal touch to the whole ordeal. They know you, they know your policy, and they can be a fantastic ally if anything gets complicated. Your agent can file the claim for you, explain any confusing policy details, and help smooth over any bumps in the road.

This route might be a tad slower than filing online, but the reassurance of having an expert in your corner is often worth the trade-off. They'll deal with the main claims office and get back to you with the claim number once it's officially in the system.

Choosing Between OEM and Aftermarket Glass

Once your windshield replacement insurance claim is approved, you've got a big decision to make: should you go with Original Equipment Manufacturer (OEM) glass or an aftermarket version? This isn't just about what's cheapest. The choice you make can affect your vehicle's safety, performance, and even how its technology functions.

Think of OEM glass as the identical twin to the windshield your car had when it first left the factory. It’s made by the same company, to the exact same specs—thickness, shape, color, everything—and it even has your car manufacturer's logo on it. This guarantees a perfect fit, every time.

The catch? Most insurance policies are written to cover the most cost-effective option, which usually means they default to aftermarket glass. If you want OEM, you might have to pay the price difference out of pocket. It's a really important conversation to have with your adjuster before any work begins.

So, What's the Deal with Aftermarket Glass?

Aftermarket windshields are simply made by companies other than the original supplier. Now, that might sound like a downgrade, but that's not the case. High-quality aftermarket glass is a safe, reliable, and perfectly acceptable alternative.

In fact, these windshields are required by law to meet or exceed the same stringent Federal Motor Vehicle Safety Standards (FMVSS) that OEM glass does. A good aftermarket windshield will offer the same clarity and structural support as its OEM counterpart. You just won't see the little automaker logo etched into the corner. Because they’re more affordable, they are often the standard choice for insurers managing a windshield replacement insurance claim.

This industry is huge. The global market is valued at over $15 billion, with most of that being driven by insurance claims. It’s what keeps mobile specialists like Auto Renu Auto Glass LLC so busy, providing both OEM and top-tier aftermarket solutions right at your doorstep. You can dive deeper into the windshield service market and its trends if you're curious.

Making the Right Choice for Your Vehicle

To help you decide, let's break down the key differences between OEM and aftermarket glass. This side-by-side comparison should make it easier to see which option aligns best with your needs, budget, and vehicle.

OEM vs Aftermarket Windshield Comparison

Feature | OEM (Original Equipment Manufacturer) Glass | Aftermarket Glass |

|---|---|---|

Manufacturer | Made by the same company that produced the original windshield for the automaker. | Made by a different company that did not supply the original automaker. |

Logo | Bears the vehicle manufacturer's official logo. | Does not have the automaker's logo. |

Fit & Quality | Guaranteed to be an exact match in fit, shape, thickness, and color. | Quality can vary by brand, but reputable options meet or exceed federal safety standards. Fit is generally excellent. |

Cost | Typically more expensive. | More affordable and budget-friendly. |

Insurance Coverage | Often requires you to pay the difference out-of-pocket, depending on your policy. | Usually the standard, fully-covered option under most comprehensive policies. |

ADAS Compatibility | Designed to work perfectly with your car's original ADAS (safety systems) setup. | High-quality versions are designed for ADAS compatibility, but a proper installation and recalibration is critical. |

Ultimately, your decision comes down to balancing your insurance coverage, your budget, and what you feel is best for your car.

If you have a newer vehicle, especially one still under warranty or loaded with complex ADAS features, sticking with OEM glass is often the safest bet. It eliminates any potential for compatibility headaches down the road. But for an older car or if you're paying for it yourself, a quality aftermarket windshield from a trusted brand gives you fantastic value without cutting corners on safety.

Key Takeaway: Remember, you have the right to choose. Don't let your insurance company or anyone else pressure you into a specific type of glass or repair shop. An experienced installer can walk you through the pros and cons for your exact vehicle.

Before you give the go-ahead, be sure to ask the auto glass shop a few direct questions:

Which aftermarket manufacturers do you use? Are they reputable?

Can you confirm this glass meets all federal safety standards?

How will you ensure this glass works perfectly with my car's rain sensors and ADAS camera?

Asking these questions upfront ensures you end up with a high-quality, safe installation that protects the integrity of your vehicle, no matter which glass you choose.

Why ADAS Recalibration Is Non-Negotiable

In modern cars, the windshield isn't just a piece of glass. It’s a sophisticated piece of technology. Tucked behind your rearview mirror, you'll find a cluster of cameras and sensors that power your Advanced Driver-Assistance Systems (ADAS). These are the brains behind critical safety features like automatic emergency braking and lane-keeping assist.

When you get a new windshield, those sensors have to be recalibrated with absolute precision. Think of it as getting a new prescription for your glasses—if it's off by even a tiny fraction, your car's vision of the road becomes dangerously blurry.

Skipping this step is a gamble you don't want to take. A misaligned camera could misjudge the distance to the car in front of you or fail to read lane markings, turning your safety features into liabilities right when you need them most.

Why Your Insurance Should Cover ADAS Calibration

Because ADAS recalibration is a fundamental part of a safe windshield replacement, most insurance companies now treat it as a required part of the job. Your windshield replacement insurance claim should absolutely include this cost. Even so, it's smart to confirm this upfront when you first file the claim.

The market for these services is exploding. Auto glass claims services globally have ballooned to $4.8 billion, largely driven by ADAS technology. Here in the U.S., a staggering $959 million was spent on calibrations for 3.8 million windshield replacements, which tells you just how mainstream this has become. You can dig deeper into auto glass claims market trends to see how this technology is changing everything.

Key Takeaway: When you talk to your insurance adjuster, ask a direct question: "Does my policy cover the cost of ADAS recalibration?" Get a clear confirmation and make sure it's documented in your claim file before work begins. This one simple step can save you from a nasty surprise bill.

Finding a Shop with the Right Tools

Here’s the thing: not all auto glass shops are created equal, especially when it comes to technology. Proper ADAS recalibration demands specialized, factory-grade tools and software to correctly interface with your vehicle's onboard computer. What a Tesla needs is completely different from a Toyota or a Mercedes.

Before you give any shop the green light, ask them a few pointed questions:

Do you perform ADAS recalibration in-house? You want a shop that handles the entire process, not one that outsources this critical safety step.

What kind of equipment do you use? A quality shop won't hesitate to tell you about their tools and confirm they have the right setup for your specific car.

Can you provide proof of a successful recalibration? A post-service report is your verification that the job was done correctly and your systems are back to factory specs.

Depending on your car’s manufacturer, a technician will perform either a static recalibration (done in the shop with targets) or a dynamic one (done by driving the car). To get a better handle on what this involves, check out our guide on ADAS calibration after a windshield replacement. Getting this done right is simply not optional.

What Happens After Your Claim Is Approved

Getting that claim approval notification is a great feeling. Now, the real work begins. Your insurance company will likely hand you a list of their "preferred" or "in-network" auto glass shops. But here's a crucial point they might not emphasize: the choice is yours. You have the right to select any certified shop you trust.

This is your opportunity to pick a specialist known for quality workmanship. Many people, myself included, lean towards mobile providers who bring the entire workshop to your driveway or office parking lot. It’s incredibly convenient.

With your claim number in hand, you can go ahead and book the appointment.

The Replacement Appointment Itself

When the technician shows up, the first thing they should do is prep your vehicle. This means carefully placing protective coverings over your dashboard, seats, and the exterior paint around the windshield to prevent any accidental scratches or adhesive drips.

They'll then remove the old, cracked windshield, meticulously clean the frame to get rid of every bit of the old seal, and apply a new, strong urethane adhesive. Finally, the new glass is carefully and precisely set into place.

Appointment Duration: The actual hands-on replacement work usually takes around 60 to 90 minutes.

ADAS Recalibration: If your car has modern safety features like lane-keep assist or automatic emergency braking, this is a non-negotiable step. The forward-facing camera needs to be recalibrated, which can add another 30 to 60 minutes to the job.

A good installer won't just pack up and leave. They'll walk you through what they did and explain the most important part of the whole process: the cure time. This isn't just a friendly suggestion—it's a critical safety measure.

Cure Time and Final Inspection

That black adhesive holding your new windshield needs time to cure and create a permanent, watertight seal. This is what ensures the windshield contributes to your vehicle's structural integrity, especially in a rollover accident.

Your technician will give you a specific "safe drive-away time," which is typically about an hour after the glass is installed. Don't rush it. Driving too soon can cause the seal to fail, leading to leaks or, worse, a compromised windshield.

Before they head out, take a moment to do a quick visual inspection with the technician. Look for a clean installation with no stray adhesive on the glass or your car's paint. Make sure the new glass is free of any distortions or defects.

So, how does payment work? The glass shop sends the bill directly to your insurance company. If you have a glass deductible, you'll pay that portion directly to the shop when the job is done. To get a better feel for the numbers involved, it’s worth knowing how much a windshield replacement costs if you were paying out-of-pocket. This direct-billing process keeps things simple and avoids any surprise bills later on.

Common Questions About Windshield Claims

Even with a detailed guide in hand, a few specific questions always seem to pop up when you're in the middle of a windshield replacement insurance claim. Let’s tackle some of the most common ones I hear from drivers, so you can move forward with confidence.

Think of this as the "what if" section for those lingering concerns.

Will a Windshield Claim Make My Insurance Go Up?

This is probably the number one fear I see, and it's a valid one. The good news is that for most drivers, the answer is no.

A single glass claim filed under your comprehensive coverage is almost always considered a "no-fault" incident. Your insurer knows that a rock flying up from a truck on the highway is just plain bad luck, not a reflection of your driving skills.

Where you can run into trouble is with frequency. While one claim is fine, filing several in a short time frame—say, two or three within three years—might trigger a review of your policy. Every company handles this differently, so it never hurts to have a quick chat with your agent about their specific rules before you file.

Do I Have to Use My Insurer's Recommended Shop?

Absolutely not. You have the legal right in nearly every state to choose your own certified auto glass shop. It's a common practice for insurance companies to suggest shops from their "preferred network," mostly for their own convenience and pre-negotiated rates. But you are never obligated to use them.

This freedom is huge. It means you can pick a local, trusted provider you know does quality work. Just tell your insurance adjuster which shop you’ve chosen, and they'll handle the payment coordination from there.

Your Right to Choose: This is a critical consumer protection law. Don't let an insurer pressure you into using a shop you're not comfortable with. The safety of your vehicle is what matters most, and you should have the final say on who does the work.

How Long Does the Whole Process Usually Take?

Most people are surprised by how quickly this all gets resolved. From start to finish, you’re not looking at a major time commitment.

Here’s a realistic breakdown:

Filing the Claim: You can knock this out in about 15 minutes over the phone or online.

Getting Approval: This is often instant, but usually takes no more than 24 hours.

Scheduling the Job: A good mobile service can often get you on the books for the same or the next day.

The Actual Work: The replacement itself takes about 60-90 minutes. After that, there's a crucial 1-hour cure time before the vehicle is safe to drive.

ADAS Recalibration: If your car needs it, tack on another 30-60 minutes.

All in, you can go from making the first call to driving away with a new windshield in just one to three days.

What if the Crack Is in My Line of Sight?

If the damage is right in your field of vision, it’s a non-starter for a repair. This is a major safety issue, and a full replacement is the only option. It's not just a recommendation; there are actual DOT windshield crack regulations that make a replacement mandatory in these cases. It’s all about ensuring nothing obstructs your view of the road.

When you're navigating a claim, working with a partner who gets it makes all the difference. Auto Renu Auto Glass LLC specializes in mobile windshield replacement and ADAS recalibration, and we handle the insurance paperwork so you don’t have to. For dealership-quality service that comes right to your door, visit https://www.autorenu911.com.